Search

CRYSTAL CLOUD

Specialist Payroll for Schools, Colleges & Universities

Managing payroll for educational institutions requires expertise in handling Teachers' Pensions (TPS) and Local Government Pension Schemes (LGPS). Mistakes in these areas can lead to compliance issues and fines, which is why we tailor our services to meet the unique payroll requirements of schools, colleges, and universities. Our payroll experts ensure:

TPS & LGPS Compliance – We handle the complexities of Teachers' Pensions and Local Government Pension Schemes accurately.

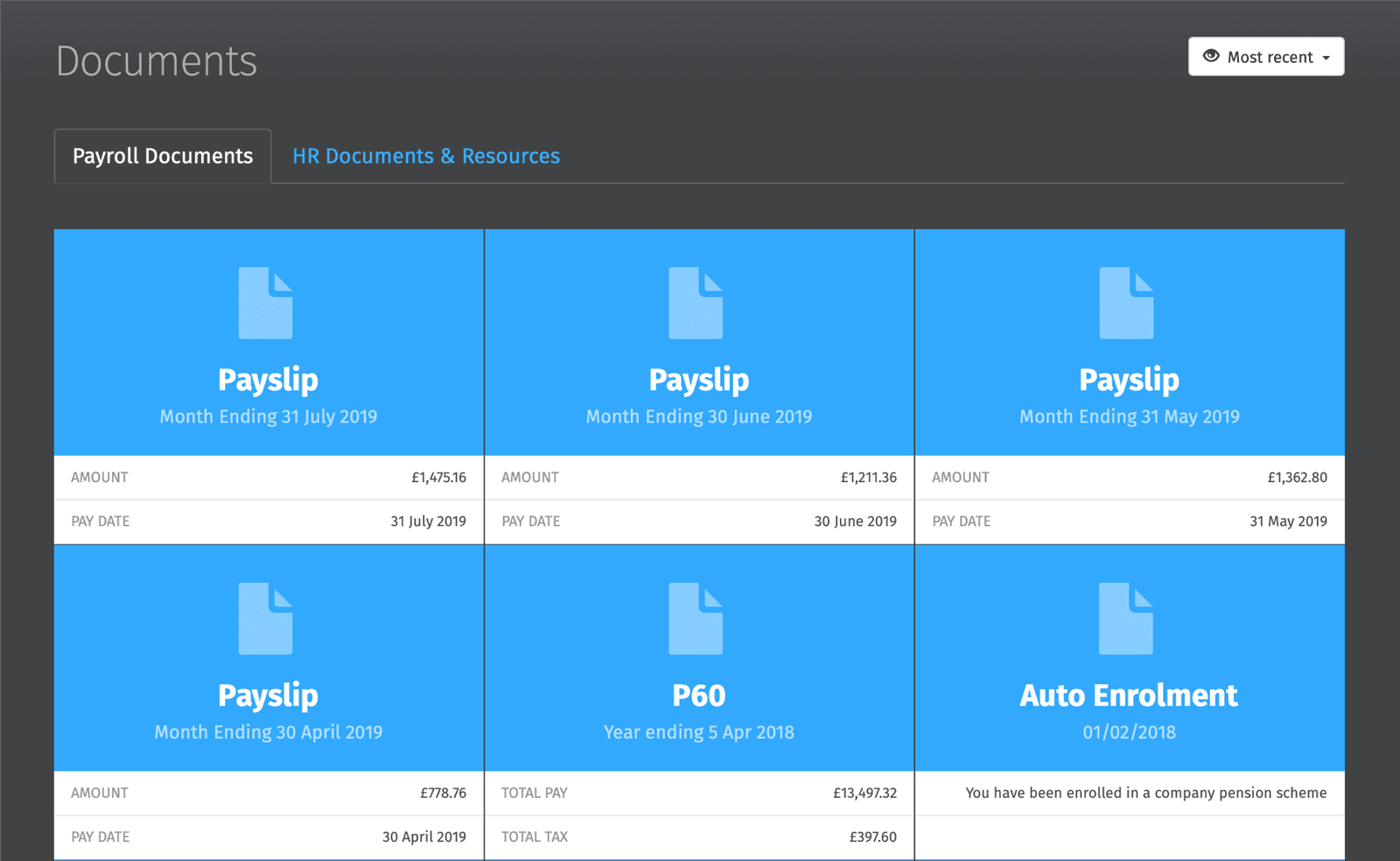

Payslip Distribution – Staff can access payslips via our self-service app or receive them by post.

Software Integration – We offer BrightPay and Sage, with Sage aligning seamlessly with school finance systems and reporting structures.

Multiple Roles & Pay Rates – We manage staff with different roles, pay scales, and pension contributions correctly.

Year-End Reconciliation – We ensure payroll, pensions, and deductions align to avoid penalties and provide audit-ready reports.

HMRC Compliance – Returns are filed on time, and Auto-Enrolment assessments are included at no extra cost.

Proactive Payroll Setup – We don’t just process payroll; we ensure everything is correctly configured from the start, preventing last-minute errors and ensuring smooth operations.

Contact us today to discuss your institution's payroll requirements and discover how we can streamline your payroll operations.

We go beyond payroll processing by ensuring compliance, accuracy, and efficiency: