Introduction

Thank you for reading our article on how to apply for tax-free childcare? Before we go any further, we need to point out that Tax-Free Childcare is only best if you can't get other state help – so check if you're eligible for free nursery hours or benefits first.

If you think you may be eligible for Tax-Free Childcare, please read on.

The UK government’s Tax-Free Childcare scheme supports working parents by helping with childcare costs. This guide explores eligibility criteria, benefits, application process, personal experiences, tips, and updates related to the scheme.

FAQs

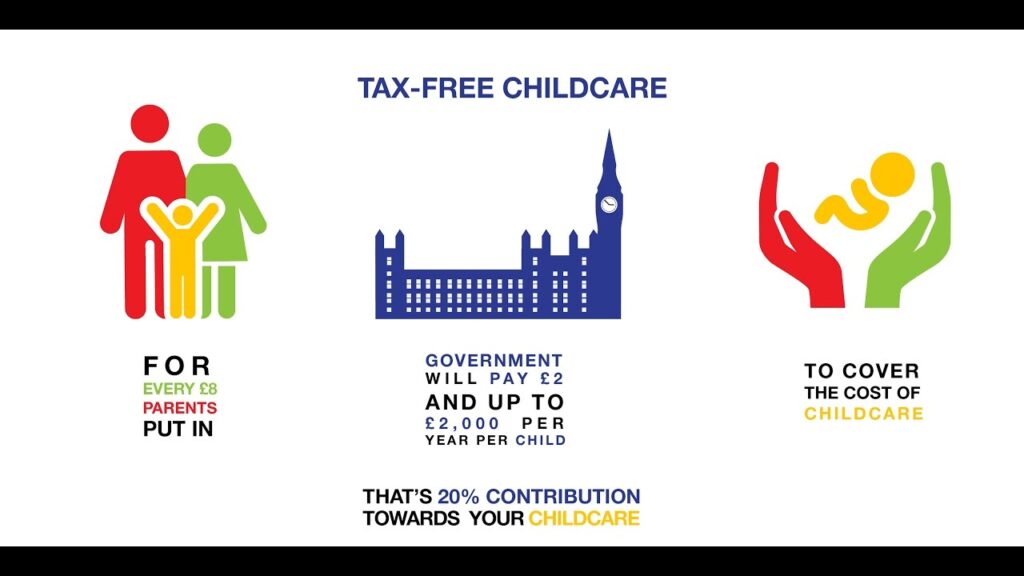

- What is the Tax-Free Childcare scheme? The scheme provides up to £2,000 a year per child (or £4,000 for disabled children) to help with childcare costs.

- Who is eligible for the scheme? Working parents with children under 12 (or 17 if disabled) who meet minimum income requirements.

- How do I apply? Create an account on the GOV.UK website, enter your details, and wait for HMRC to verify your eligibility.

- What documentation is needed? National Insurance number, UTR if self-employed, and other relevant income evidence.

The Tax-Free Childcare scheme provides financial relief for working parents. By understanding the eligibility criteria, benefits, application process, and tips, families can effectively utilize this support to manage their childcare expenses. Staying updated with any changes to the scheme means that parents can continue to benefit from this tax free allowance.

Eligibility Criteria

To qualify for Tax-Free Childcare, both parents (or the sole parent in a single-parent household) must be working and earning at least the National Minimum Wage or Living Wage for 16 hours a week. This equates to at least £152 per week.

The scheme is available for children under 12 (or under 17 if disabled). Additionally, neither parent can have an income exceeding £100,000 per year. For more detailed eligibility criteria, visit the GOV.UK eligibility page. You can also check what help you could get with childcare costs, or check the HMRC calculator to see what help you could get.

Don't forget, your tax credits will stop immediately if you successfully apply for Tax-Free Childcare.

You (and your partner, if you have one) will also have to cancel your Universal Credit and childcare vouchers, so check it's the right option for you before applying.

Benefits of Tax-Free Childcare

The scheme offers up to £500 every three months (up to £2,000 per year) for each child to help with the cost of childcare. For disabled children, the benefit increases to £1,000 every three months (up to £4,000 per year). The money can be used for a variety of childcare services, including nurseries, childminders, nannies, after-school clubs, and play schemes.

Example

If a family have two children, one of whom is disabled. Over the course of a year, they can receive up to £2,000 for the non-disabled child and up to £4,000 for the disabled child, totaling £6,000.

If their annual childcare costs amount to £10,000, the Tax-Free Childcare scheme covers 60% of these expenses, significantly reducing the family's financial burden.

For more information on approved childcare providers, check out HMRC's guide on approved childcare.

How to apply

Applying for Tax-Free Childcare involves setting up an online account via the HMRC website. Here's how to apply for tax-free childcare:

- Create an Account: Visit the official GOV.UK website and create a Government Gateway user ID.

- Enter Details: Provide personal details, including National Insurance number and your child’s details. If you’re self-employed, include your Unique Taxpayer Reference (UTR).

- Eligibility Check: HMRC will verify your details to confirm eligibility.

- Account Activation: Once approved, you can start depositing money into your Tax-Free Childcare account.

For more detailed instructions, refer to HMRC’s application guide.

Additional Documentation

- For Employees: Provide your National Insurance number and if applicable, your partner’s details.

- For the Self-Employed: Include your Unique Taxpayer Reference (UTR).

- For Directors: Provide evidence of meeting minimum income requirements through wage slips, bank statements, or a statement from your accountant.

Refer to the HMRC’s detailed guide for more information.

Testimonials

Emma’s Story

Emma, a working mother of two, shared that the scheme significantly reduced her childcare expenses, allowing her to afford higher-quality childcare services.

Jack’s Experience

Jack, a single father, appreciated the straightforward application process and the immediate impact on his finances.

Additional Testimonials

More stories and experiences can be found on Mumsnet, where parents discuss their experiences with Tax-Free Childcare.

Tips for Maximizing Benefits

- Plan Contributions: Make regular contributions to your childcare account to ensure you maximize the government top-up.

- Check Eligibility Regularly: Changes in employment status or income can affect your eligibility, so keep your details updated.

- Combine Benefits: If you have multiple children, remember the maximum amount applies per child, so plan accordingly.

- Utilize All Resources: Use the funds for various approved childcare services, including holiday clubs and after-school activities.

For more advice and tips, see the Money Saving Expert guide from Martin Lewis, Tax-Free Childcare

Updates and Practical Advice

The government periodically updates the scheme, so it’s essential to stay informed about any changes. Recent updates include extended support for parents impacted by COVID-19 and adjustments to income thresholds. Keep up with the latest updates on GOV.UK Tax-Free Childcare news.

Ready to apply? Visit the official Tax-Free Childcare page to start your application.

If you need help with this article, or have any questions, please contact us on 0345 564 5774 or complete our web form

Article is correct at time of revision, 24th July 2024. Always check or seek professional advise before apply for any benefits.