So you’ve started your own business and realize you need to employ someone, (congratulations by the way, on getting this far, it’s a achievement in it’s own right).

Employing someone for the first time is a big step and there’s a lot to consider, interviewing people, their suitability for the role, employers insurance, training, HR, payroll, the list goes on and these are just some of the things you need to consider, we know, we were once a new employer ourselves.

In this series of articles we aim to touch on and give you a better understanding of payroll and the things you must do and the things you need to think about.

Over the coming weeks, we’ll be posting new articles. Each article will have relevant links to various sources of information to help you further, such as HMRC or The Pension Regulator, but if there’s something, we haven’t covered send us an email with your question and we’ll get right back to you.

So lets jump in…..

Here’s a list of the topics to be covered:

- An introduction to PAYE

- Payments and Deductions

- Reporting to and paying HMRC

- Registering as an Employer

- Payroll Software

- Outsourcing Payroll

- Starters and Leavers

- What is a Tax Code and What Does it Mean?

- Running Payroll for the First Time

- What You Need to Know About Workplace Pensions

- Paying your Employee/s

- Paying HMRC

- Payroll Year End (Employer and Employee)

- Statutory Payments, such as Maternity Pay, Sick Pay

- Tips for Payroll

An introduction to PAYE

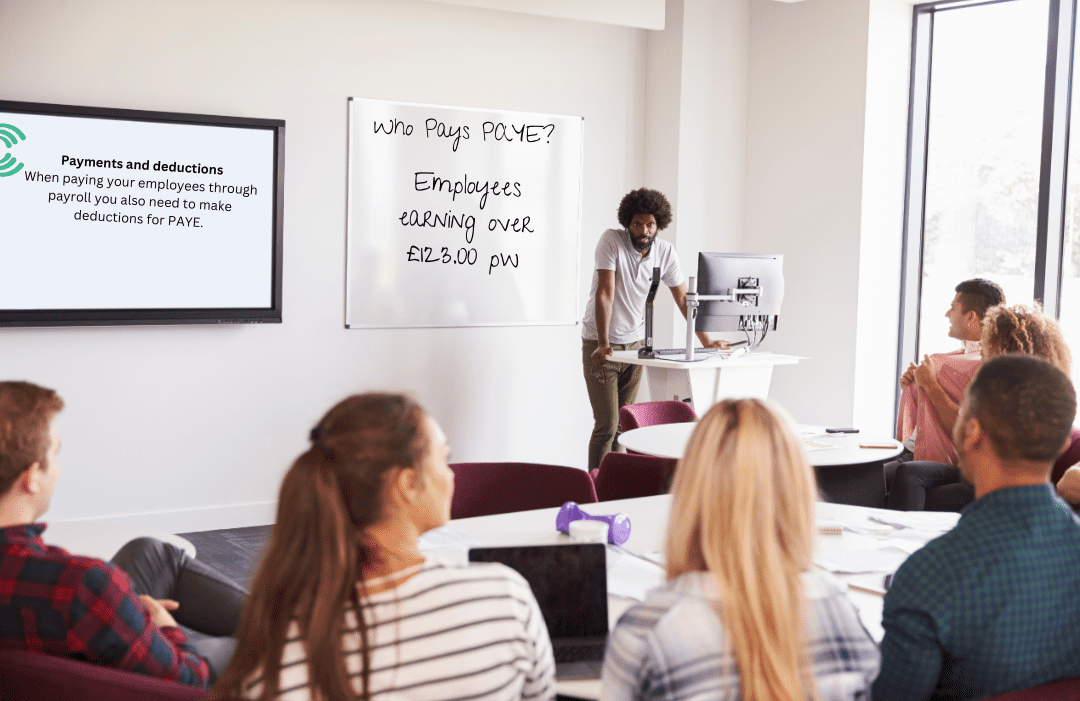

PAYE stands for Pay As You Earn and is a system for recording pay and deductions for your employees and reporting this information to HMRC, (His Majesty’s Revenue & Customs).

! If your employee earns less than £123.00 per week, or £533.00 per month, you do not need to register with HMRC for PAYE, BUT YOU DO NEED TO KEEP PAYROLL RECORDS. These figures are correct at date and time of writing. Always check with HMRC.

Payments and Deductions

Payments to your employees

Generally speaking, when you pay your employee/s this will include things such as basic pay, overtime payments, commission, bonus, expenses. With the exception of expenses, these items of pay are generally referred to as “Gross Pay”

! Expenses, such as a remote employee buying a stamp for work, are job-related costs listed as "expenses" on payslips and are exempt from income tax, national insurance, and pension contributions .

Deductions from their pay

There are a number of deductions that may need to be made from your employees pay such as national insurance, income tax, pension contributions. Other types of deductions can include, student loan, company loan, advance payments, union fees, attachment orders.

Reporting to and paying HMRC

If you are running payroll yourself, you’ll need to report all of your employees pay and deductions to HMRC on or before, each pay day via an FPS, (Full Payment Submission). This is the name given to the report you will send via your payroll software. The FPS details all employees on your payroll, how much they have been paid and all of the statutory deductions from their pay, such as income tax and national insurance.

! It is important you send payroll information on or before your pay date. If you send payroll information late, you may get a fine or a penalty if you don't have a valid reason.

Your payroll software should work out how much tax and national insurance you owe HMRC

If you are claiming any money back from HMRC, you will need to file another report, known as an EPS or Employer Payment Summary. Things you can claim back are Statutory Maternity Pay, Paternity Pay. These items will reduce the amount of money you owe HMRC.

Paying HMRC

There are a number of ways to pay HMRC, Direct Debit, Standing Order, Online Payment and you can find details here of the different ways to pay HMRC.

Recap

- PAYE stands for Pay as you Earn

- If your employee earns less than £123.00 per week, you do not need to register as an employer but must keep payroll records

- Salary, basic pay, overtime, bonus, commission are all types of gross pay

- Expenses are exempt from income tax and national insurance

- Types of deductions from pay are income tax, national insurance, pension contributions, student loans, union fees, attachment orders

- You must file your payroll returns with HMRC on or before your wages/salary pay date.

- To claim money from HMRC you must file a separate return. You can claim for things such as maternity pay

So that’s about it for this article.

We hope it has given you an overview of Payroll and PAYE. If you found it useful, why not check out the next article in the series, How to Register as an Employer with HMRC

Our next article will cover registering with HMRC as an employer and will take you step by step through the process. In the meantime, if you have any questions, would like us to cover other topics or just need help with your payroll, please get in touch for a confidential, no obligation chat.