The Spring Budget 2024 introduces pivotal changes to national insurance contributions for employees and changes to the High Income Child Benefit Charge. At Crystal we understand the importance of staying ahead of these changes and hope this article will give you some insight into what these changes actually mean for you.

National Insurance Adjustments: What You Need to Know

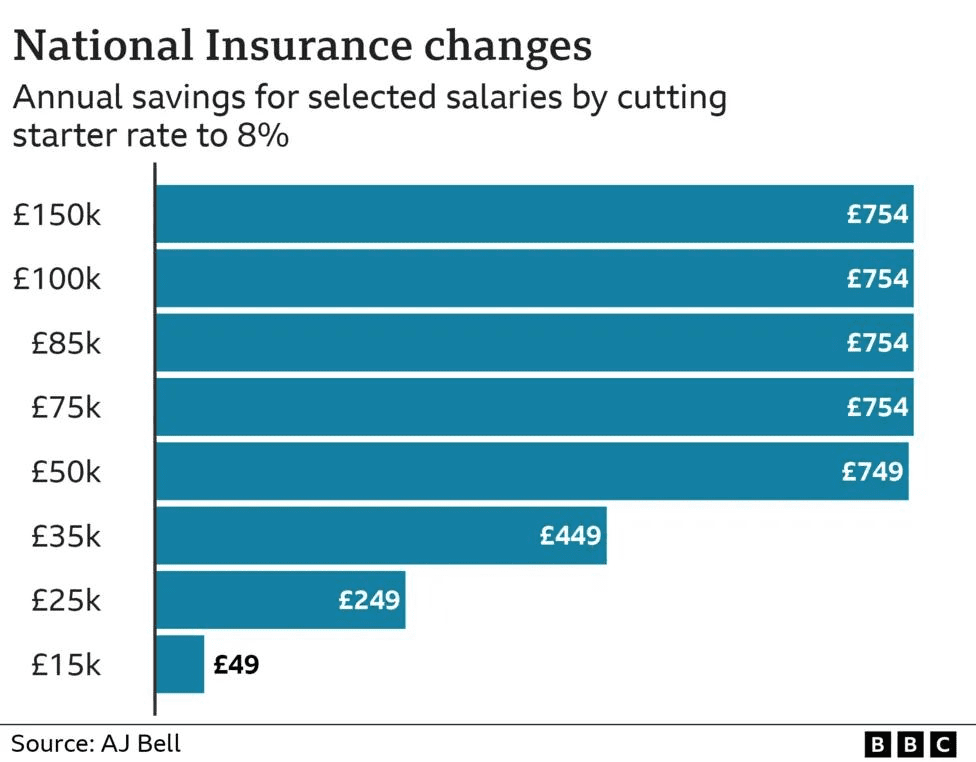

For employees, the changes signify a shift in take-home pay, affecting overall take-home pay and, potentially, salary sacrifice schemes. Employers, on the other hand, need to check payroll calculations and consider the impact on their employee benefits planning.

A Closer Look at Salary Sacrifice Schemes

Salary sacrifice schemes, where employees opt to forgo a portion of their salary in exchange for benefits (such as pension contributions), may see a shift in value due to these changes. Let's have a look at an example:

Imagine an employee opts into a salary sacrifice scheme, exchanging £100 of their monthly salary for additional pension contributions. Prior to the budget changes, with national insurance contributions at 10%, this exchange would save the employee £10 in national insurance (since the £100 is no longer subject to these contributions). However, now the national insurance rate has been adjusted to 8%, the same £100 sacrifice would now save £8, making the benefit slightly less advantageous in terms of national insurance savings, though still beneficial overall.

This change means that both employees and employers need to reassess the attractiveness and efficiency of participating in salary sacrifice schemes. Employers must ensure they communicate these changes effectively, ensuring employees understand the implications for their pay and salary and overall benefits package.

High Income Child Benefit Charge: A Closer Look

The adjustments to the High Income Child Benefit Charge highlight the government's approach to support families while managing their fiscal responsibilities. Understanding these changes is crucial for eligible individuals to navigate potential implications on their financial planning.

Practical Examples and Considerations

Consider a scenario where an employee participates in a salary sacrifice scheme for childcare. The interplay between the adjusted national insurance contributions and the High Income Child Benefit Charge could influence the net benefit of such arrangements. Employers and employees should review these schemes to ensure they remain beneficial under the new tax rules.

Expert Advice from Crystal HR & Payroll Ltd

As a company working hard to become a leading HR and payroll provider, Crystal is committed to keeping you informed and ready for any changes that affect your payroll. For more information on the Spring Budget 2024, explore the following resources:

New Guidance on High Income Child Benefit Charge You may wish to share this with your employees.

Overview of National Insurance and High Income Child Benefit Charge

Tax Legislation and Rates Overview

If you need help with payroll or salary sacrifice, get in touch or get an instant online quote

Thank you for reading and we hope you will enjoy other articles we've written. We value your feedback so if you have any comments on this article, please do let us know