2024 UK Wage Update: Living and Minimum Wage Increases

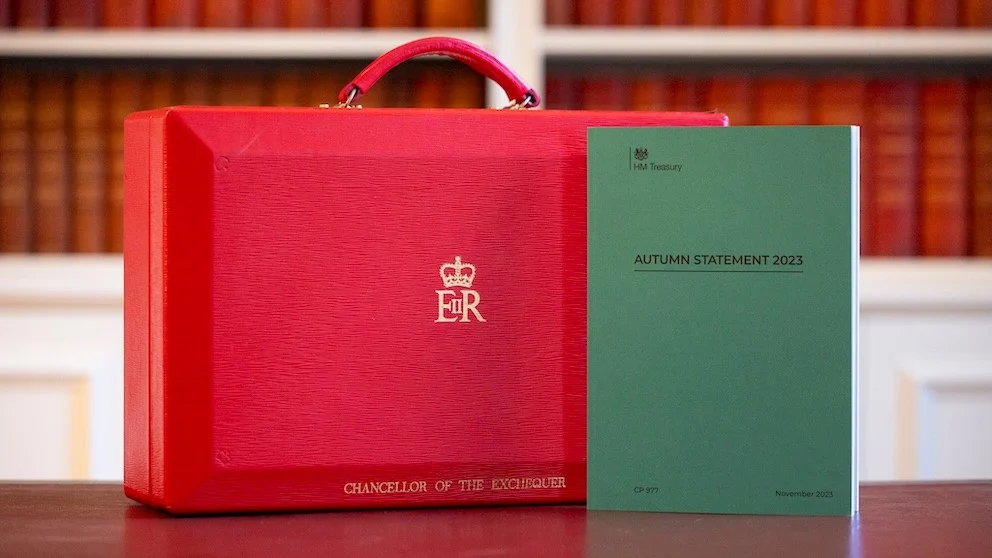

- The Autumn Statement 2023, announced on 22 November, introduces pivotal changes for payroll and tax regulations. This guide simplifies these changes, making them easily understandable for small business owners and entrepreneurs.

- Key Changes Affecting Your Business

- Reduction in Employee National Insurance: Starting 6 January 2024, the National Insurance rate for employees drops from 12% to 10%.

- Increase in National Living Wage: From 1 April 2024, the national living wage will be £11.44 for those aged 21 and over.

Starting in April 2024, there will be a significant change in the wages for UK workers. The National Living Wage, which is the lowest wage legally payable to workers aged 23 and over (excluding those in their first apprenticeship year), is set for a rise. According to the latest announcement by the Chancellor, from 1st April 2024, the National Living Wage will go up from £10.42 to £11.44 per hour. Additionally, this rate will now also apply to workers aged 21 and over, who were previously entitled to the National Minimum Wage of £10.18.

It's important to note that the National Living Wage and the National Minimum Wage, while often confused, are distinct. The National Minimum Wage is the minimum legal wage for younger workers and apprentices. This rate is also set to increase from 1st April 2024, although the new rates have not been announced yet.

More details can be found on the Living Wage Foundation website

- Changes to Self-Employed NICs: Class 2 NICs will be abolished, and Class 4 NICs will reduce to 8% from April 2024.

- Additional Relief for Employers of Veterans: New NI reliefs will be available for employers of veterans from April 2024.

| 2023/24 Weekly Threshold | 2023/24 Annual Threshold | 2024/25 Weekly Threshold | 2024/25 Annual Threshold | |

| Lower Earnings Limit (LEL): Employees earning below the LEL do not pay National Insurance and don’t earn State Pension contributions. Above LEL, Below Primary Threshold: Employees in this earnings range don't pay National Insurance but receive NI credits, which count towards NI benefits. | £123 | £6,396 | £123 | £6,396 |

| Primary Threshold Earnings: 6th April 2023 – 5th January 2024: Earnings above the Primary Threshold and up to the Upper Earnings Limit are subject to a 12% National Insurance rate. 6th January 2024 – 5th April 2024: During this period, the National Insurance rate for the same earnings range is reduced to 10%. 2024/25 Financial Year: The National Insurance rate remains at 10% for the entire fiscal year for earnings within this threshold. | £241.73 | £12,570 | £241.73 | £12,570 |

| Upper Earnings Limit (UEL): For 2023/24 and 2024/25: Earnings exceeding the Upper Earnings Limit are subject to a National Insurance rate of 2% for both financial years. | £967 | £50,270 | £967 | £50,270 |

Why Outsourcing Payroll Matters

These updates can be complex, especially for small businesses already juggling multiple responsibilities. Outsourcing payroll to specialists like Crystal HR & Payroll Ltd ensures accuracy, compliance, and saves valuable time. Our services are tailored to keep your business up-to-date with the latest regulations. For expert advice, contact us at 0345 564 5774

Pensions and Benefits: What You Need to Know

- State Pension Increase: Expect an 8.5% increase in state pensions from April 2024.

- Rise in Universal Credit and Other Benefits: A 6.7% increase aligns with the consumer price index.

2024 UK Wage Update: Living and Minimum Wage Increases