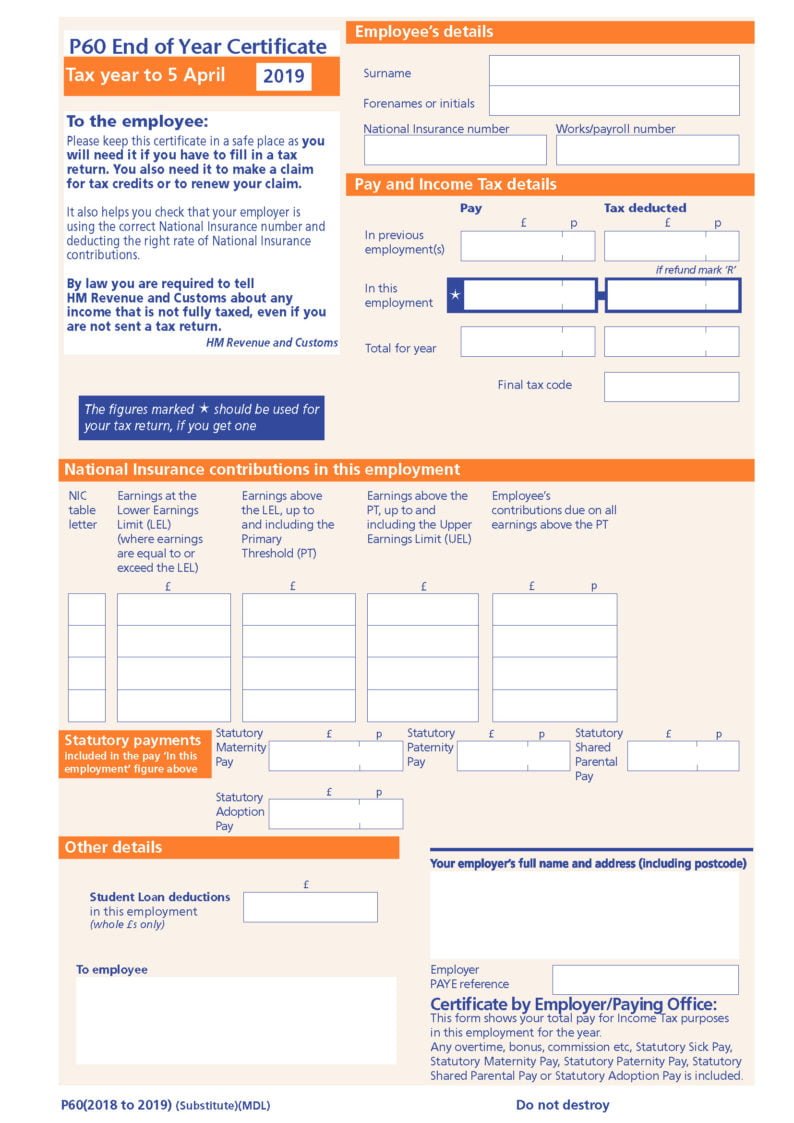

What is P60?

A P60 is a tax certificate that shows how much tax you have paid on your salary or certain benefits between 6th April to 5th April the following year.

A P60 is issued if you are employed on 5th April or in receipt of taxable benefits. It is important you keep your P60 safe as it can not, under normal circumstances be replaced, .

If the P60 does need to be changed, you should get a new P60 marked "replacement" and the replacement can be paper or electronic together with a letter confirming the change.

Why is a P60 important?

A P60 proves how much tax you have paid in the tax year the P60 is issued.

You might need a P60 to:

- complete a Self Assessment tax return

- claim back any tax you've overpaid

- apply for tax credits

- proof of your income

From 2010-11 tax year a form P60 can be provided on paper or electronically and should be issued no later than 31st May following the end of the tax year on 5th April.

How can Employers order P60s?

Employers can order P60s and other forms direct from HMRC here

Need help with your payroll?

for a no obligation quote

#gettingitrightmatters