September 2022 Mini Budget and What it Means for Payroll

Although today’s announcement was a mini budget there was a lot of content to digest.

So what does it all mean for payroll?

Income Tax Cut

The previously announced income tax cut will now be brought forward to April 2023 at the start of the 2023/24 tax year. The Chancellor announced a 1p in the pound cut to the basic rate of income tax.

This means for someone earning £20,000 per year they will be £75.00 per year better off, or £1.44 per week better off. Someone earning £30,000 per year will be £175.00 per year better off or £3.36 per week.

Due to the income tax band freezes, more people are paying income tax. The Chancellor announced plans to abolish the 45% additional rate of income tax in April 2023.

Income bands are different in Scotland

Potential Benefit Cuts

We do not normally comment on benefits as they do not directly affect payroll, but we feel it is important to note that anyone on the main benefits will receive a rise from April 2023 as benefits are linked to inflation.

Mr Kwarteng has stated he plans to concentrate on a plan to cut benefits for anyone who does not actively seek work, or better paid work.

National Insurance

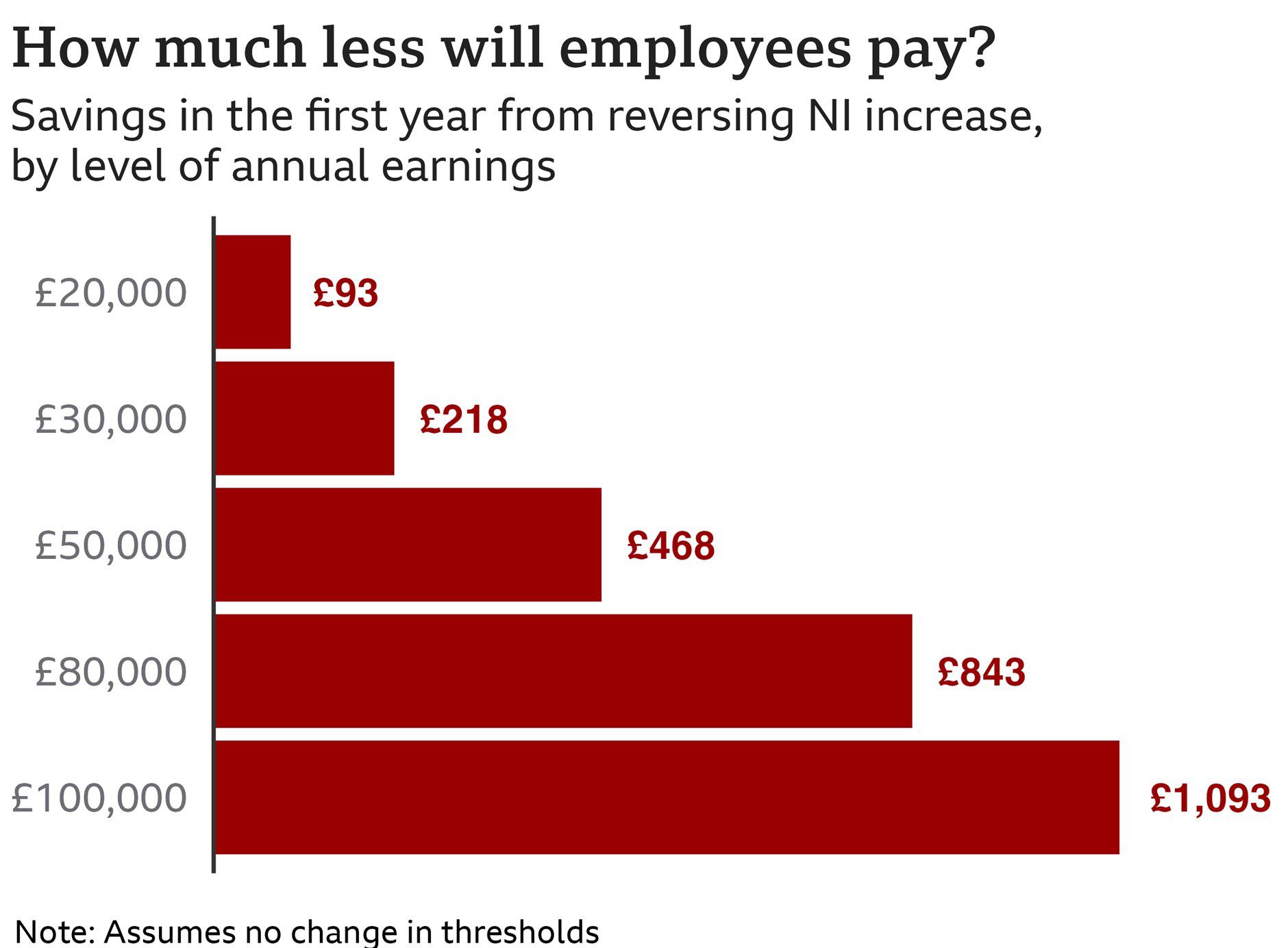

The Chancellor has announced in his mini budget a reversal of the National Insurance rise of 1.25% as of 6th November citing this will save the average employee £330.00 per year, however this is speculative as it depends totally on what someone earns.

You can find details of the current national insurance rates on the HMRC website.

As the threshold is £12,570, anyone earning less than this, will see no benefit to their pay, only employees earning more than £12,570 will benefit and the more the employee earns, the more they will benefit.

Mini Budget Summary

Employees and employers will be better off, if the employee earns above the threshold for income tax and national insurance, however with inflation set to continue to increase, these changes will by and large have little material impact on employees earning below £30,000 per year.

The big impact of these changes will be felt by higher earners earning £50,000 per year or more.

If you are struggling with making these changes as they come in to effect and need help with your payroll, get in touch for a no-obligation chat, and we'll be happy to help .